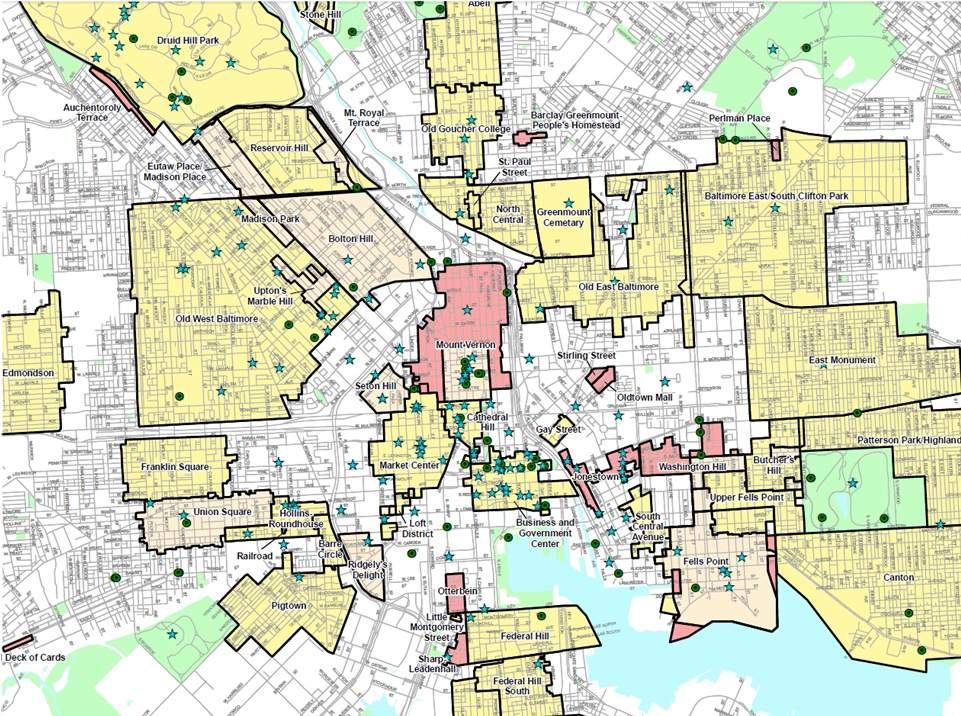

Baltimore Heritage and Retrofit Baltimore are offering a new joint workshop in Charles Village on upgrading your home’s energy efficiency while saving money with city and state historic tax credits. Working with Retrofit Baltimore on energy efficiency upgrades can improve your home’s comfort and reduce your energy bills by up to 40%, minimize your environmental impact and create jobs for underserved Baltimore residents. For homeowners in historic districts, like Charles Village, Homeland, Hampden and more, many of these improvements, including replacement HVAC systems, insulation, and wood window restoration, may also qualify for the city and state historic tax credit programs. Find out how to check if you are in a historic district with our overview of historic districts or learn more with our guide to historic tax credits. Don’t forget to take a look at our collection of resources for historic homeowners.

Join us at the Charles Village Benefits District offices on June 27 for a quick one-hour workshop that offers an introduction to weatherization, energy audits, incentives for energy efficiency, and historic tax credits. RSVP today!

Weatherization & Historic Tax Credits Workshop

Wednesday, June 27, 7:00 pm to 8:00 pm

Charles Village Community Benefits District Office

2434 Saint Paul Street, Baltimore, MD 21218

Questions? Contact Eli Pousson, Baltimore Heritage at pousson@baltimoreheritage.org or Evie Schwartz, Retrofit Baltimore at eschwartz@retrofitbaltimore.