City Hall considers selling 15 historic landmarks: Baltimore plans to hire consultant to determine market value of Shot Tower, Civil War Museum, other sites, The Baltimore Sun, March 20, 2012

Free historic tax credit education workshops extended through April

With the great response to our workshops over the last few months we’ve decided to add two more dates in March and April! Join us for our February workshop tonight or mark your calendar for an upcoming program. Learn more about historic tax credits with our guide to city, state and federal programs or learn more about historic districts.

- Tuesday, February 21

- Thursday, March 22

- Tuesday, April 17

All workshops will be held from 7:00 pm to 8:00 pm at the AIA Baltimore basement gallery, 11 1/2 West Chase Street. RSVP today!

Our historic tax credit workshops offer a brief introduction to Maryland Historic Rehabilitation Tax Credit program — a 20% refundable income tax credit program for home-owners working on rehabilitation projects in designated historic districts — together with information on the Baltimore City historic tax credit for homeowners and businesses.

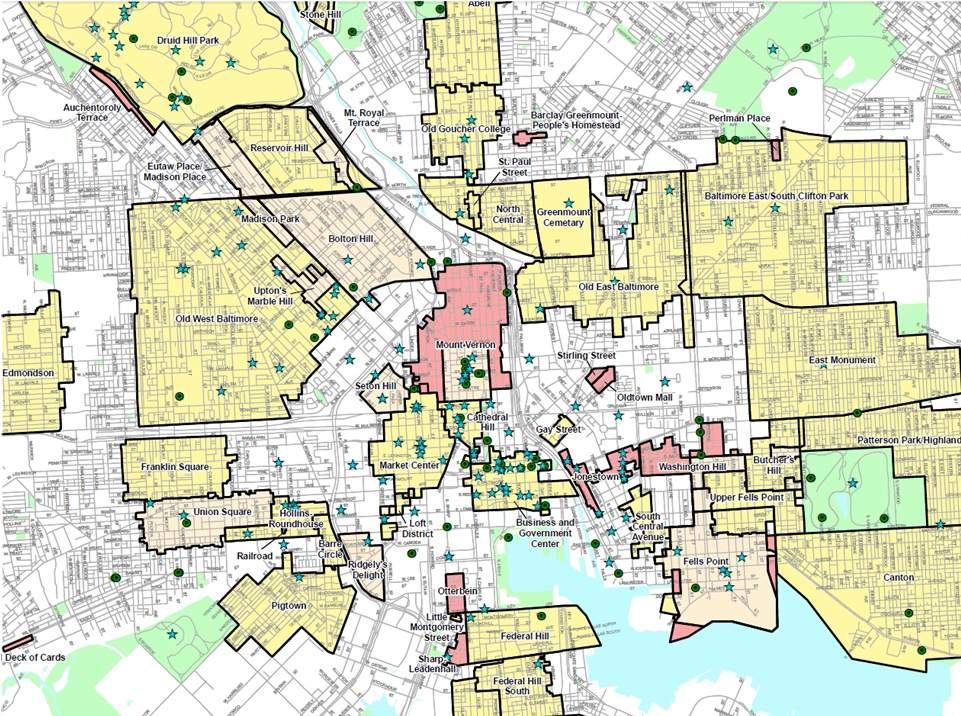

With over seventy historic districts across the city, thousands of Baltimore home-owners are eligible for tax credits on projects as diverse as repairing damaged masonry, restoring wood windows, replacing an aging furnace, repainting and more. Not sure if you are in a historic district? Check online using the Baltimore CityView Map (select “Landmarks & Historic Districts” from the drop-down menu of “Thematic Overlays”) or download a PDF map of Baltimore City historic districts.

Questions? Contact Eli Pousson, Field Officer at pousson@baltimoreheritage.org or 301-204-3337.

Make a nomination for the 2012 Baltimore Heritage Preservation Awards

For over 50 years, Baltimore Heritage has granted awards from small rowhouse rehabs to major redevelopment and adaptive reuse projects. We’d love to hear from you this year with nominations for any people or organizations you think have worked especially hard to preserve our heritage or revitalize our historic neighborhoods. To give you a few ideas about the great projects that have won in the past, look out for more posts highlighting 2011 award winners over the next few weeks.

For over 50 years, Baltimore Heritage has granted awards from small rowhouse rehabs to major redevelopment and adaptive reuse projects. We’d love to hear from you this year with nominations for any people or organizations you think have worked especially hard to preserve our heritage or revitalize our historic neighborhoods. To give you a few ideas about the great projects that have won in the past, look out for more posts highlighting 2011 award winners over the next few weeks.

Take a look at our award categories and nomination guidelines or go ahead and make a nomination today. It only takes a few minutes to submit a nomination with a brief description of the project and contact information for project participants. Photographs (the more the better!) can be submitted by e-mail to awards@baltimoreheritage.org or by mail on a CD sent to 11 1/2 West Chase Street. The deadline for submissions is April 4, 2012. Contact Johns Hopkins, Executive Director at hopkins@baltimoreheritage.org or 410-332-9992 for more information.

Hebrew Orphan Asylum receives $2.5 million in support from the Maryland Sustainable Communities Tax Credit

We are very pleased to share the news that the Baltimore Hebrew Orphan Asylum has received over $2.5 million in support from the Maryland Sustainable Communities Tax Credit program. We are honored to have helped draft the tax credit application and to be one of the many partners working towards the building’s restoration. The state’s generous funding for the project is a major step forward in our efforts to see this building preserved and reused as an anchor for a revitalized Greater Rosemont community. We particularly appreciate the leadership of Coppin State University for their support of the tax credit application prepared by the Coppin Heights Community Development Corporation with assistance from Baltimore Heritage and Kann Partners. Working together we’ve established a vision for the future of this building that matches the key goals of the Sustainable Communities Tax Credit program: to promote revitalization, restore historic places, and advance Smart Growth and sustainability while creating jobs in communities across the state of Maryland.

We are very pleased to share the news that the Baltimore Hebrew Orphan Asylum has received over $2.5 million in support from the Maryland Sustainable Communities Tax Credit program. We are honored to have helped draft the tax credit application and to be one of the many partners working towards the building’s restoration. The state’s generous funding for the project is a major step forward in our efforts to see this building preserved and reused as an anchor for a revitalized Greater Rosemont community. We particularly appreciate the leadership of Coppin State University for their support of the tax credit application prepared by the Coppin Heights Community Development Corporation with assistance from Baltimore Heritage and Kann Partners. Working together we’ve established a vision for the future of this building that matches the key goals of the Sustainable Communities Tax Credit program: to promote revitalization, restore historic places, and advance Smart Growth and sustainability while creating jobs in communities across the state of Maryland.

Although the Hebrew Orphan Asylum is just one of of many projects receiving the tax credit across the State, this project received the largest allocation from the nearly $7 million in tax credits offered to projects across the state, including the Senator Theatre and Mount Vernon Mill No. 1 here in Baltimore. These funds will leverage additional public and private support as we work to help the Coppin Heights CDC raise the full amount required for a complete stabilization and rehabilitation of the building. With the building still in seriously distressed condition, these next steps are an urgent priority for Baltimore Heritage and the Friends of the Hebrew Orphan Asylum.

Please support our efforts to preserve the Hebrew Orphan Asylum by connecting with the Friends of the Hebrew Orphan Asylum on Facebook or donate $20 to Baltimore Heritage today.

Jobs, energy efficiency, and historic preservation are now before Congress

Yesterday afternoon, Senator Ben Cardin announced the introduction of new legislation in Congress to expand the reach of the federal historic rehabilitation tax credit program. This would be great news for us in Baltimore, and in fact Senator Cardin chose Baltimore’s own Clifton Mansion, which the nonprofit Civic Works is restoring with the help of the current federal program, as the location to make his announcement.

Senator Cardin’s bill, the Creating American Prosperity through Preservation (CAPP) Act, helps smaller projects by increasing the tax credit on projects of $5 million or less and promote energy-efficiency. By supporting historic preservation across the nation, this bill also has tremendous potential to create jobs as Senator Cardin said yesterday:

“I am extremely proud of this bill because it will help ensure that historic properties are restored and made useful once again, while creating jobs that will stimulate greater economic activity. The Historic Tax Credit has created some 2 million jobs nationwide since 1978 and by expanding the program to include energy-efficient improvements and additional restoration projects, we can create thousands of new jobs in renovating historic properties.”

In Baltimore, the federal credit has been instrumental in numerous historic rehab projects including the American Can Company, Tide Point, the Hippodrome Theater, Clipper Mill, and Montgomery Park, just to name a few. The National Trust for Historic Preservation joined Senator Cardin in announcing that the CAPP Act is their top legislative priority for 2012. Republican Senator Olympia Snowe from Maine is a co-sponsor of Senator Cardin’s bill and with bi-partisan support in the Senate we hope that Senator Cardin is successful and that the bill will become law.